Total Savings from Rate Review Programs

As part of the Rate Review Grants program, HHS collects data from states on all rate increases, even those below 10 percent. Based on this information, the estimated national average rate increase implemented in the individual market in 2011 is approximately 1.4 percent lower than the increase originally requested by insurance companies.[6] Based on 2011 individual market premium data, this difference would equate to nearly $425 million in savings to consumers.

In the small group market, the estimated rate increases implemented are approximately 0.8 percent lower than the rate originally requested by insurance companies.[7] Based on 2011 small group market premium data, this difference would equate to over $600 million in savings to consumers. Taken together, premiums in the individual and small group market were lowered by an estimated $1 billion compared to the amount initially requested due to rate review.

III. Transparency: Increasing Publicly-Available Information and Shedding Light on Rate Increases

The Effective Rate Review Program also increases transparency in the insurance market. This requirement provides consumers with unprecedented access to information from insurance companies explaining why increases in rates are necessary, as well as to the reasoning behind rate review determinations made by the states and HHS.

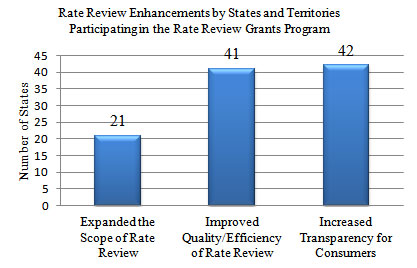

Forty-two states have used the Rate Review Grants Program funds to make the rate review process more transparent for consumers. Examples include:

- Arizona: The Arizona Department of Insurance (ADOI) created a Health Filing Access Interface called the gRate Detective,h a program developed by the NAIC providing access to open and closed filings online. During the third fiscal quarter of 2012, the ADOI held three community information meetings on rate review grant activities and two oral proceedings on the Individual Threshold Rate Review Rule. The ADOI Rules analyst received over 1,000 comments on the Individual Threshold Rate Review Rule.

- Arkansas: As of January 4, 2012, the Arkansas Insurance Department launched a Facebook page and Twitter feed. Using these popular forums provides additional means for consumers to access information and learn about premium rate review.

- Connecticut: On April 5, 2012, the Connecticut Insurance Department formally requested that insurance companies notify their individual and small group policyholders each time they submit a rate increase request to the Department and notify them of the option to access the submission and submit comments.

- Kansas: The Kansas Insurance Department conducted public forums in three Kansas counties, providing information regarding the Departmentfs rate review process and the components of premium rate increases.

- Montana: The Montana Commissioner of Securities and Insurance contracted with two consumer non-profits to develop materials to educate consumers and small businesses about rate review and Medical Loss Ratio requirements and how they could benefit from these programs. These efforts included door-to-door outreach, targeted mass mailings and e-mails; in-person, audio and webinar presentations; engaging small business leaders to educate the public and small businesses by documenting and sharing personal stories, providing spokesperson training, holding public events, and placing stories in the news, op-ed pieces, and letters to the editor.

- Nevada: The Commissioner of the Nevada Division of Insurance and the Grant Project Director conducted an annual informational tour of three rural communities in June 2012. On the tour, they performed outreach activities to these rural areas and it was so well received that the Division is planning to conduct more outreach activities in the future, which include scheduling town hall meetings with interested groups and individuals, and using Public Service Announcements to promote use of the Rate Review website.

- New York: The New York Department of Financial Services discloses rate filings to the public for comment as part of the prior approval process. The website also contains FAQs, information concerning proposed rate increases including plain English narrative summaries by insurers, information regarding approved rate increases by insurers, and comments on rate increases submitted by the public.

- Oregon: The Oregon Department of Consumer and Business Services posts all correspondence between the Department and insurer actuaries on its website daily. The Department held five public hearings in a three month period to allow the public to participate and learn about rate review and cost drivers, three of which were streamed live. The Department also developed new interactive comparison tools to allow consumers to compare issuers, and changed its rate filing requirements to aid consumers in determining the impact of a proposed rate change on their coverage.

- Rhode Island: The Rhode Island Office of the Insurance Commissioner held meetings with the Small Employer Taskforce to educate and engage the small business community on health care cost drivers.

- Washington: The Washington State Office of the Insurance Commissioner received numerous comments regarding 15 different filings on its Rate Transparency website. Website traffic consisted of 6,871 page views, including 4,814 unique page views, with a bounce rate of 55 percent. The average visitor spent two minutes on a page. As of June 30, 2012, the website had 238 subscribers.

- West Virginia: The West Virginia Office of the Insurance Commissioner has a public kiosk area where consumers can view, print, and save rate filings by burning them onto a CD.

IV. Improving the Rate Review Processes at the State Level: The Rate Review Grants Program

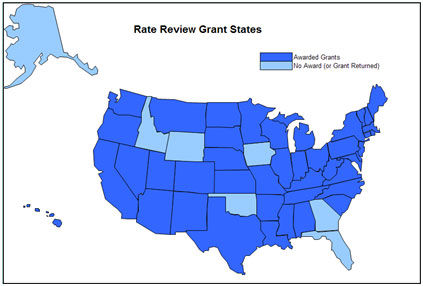

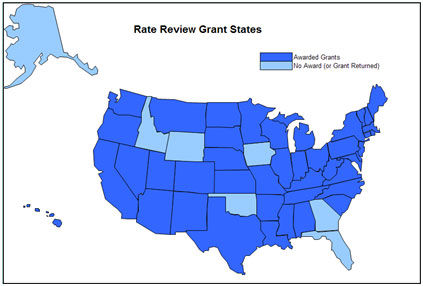

The Rate Review Grants Program is helping states and territories expand the scope, breadth, and quality of their rate review processes and helping states create ways of explaining health insurance rates that empower consumers with health insurance premium information that was previously unavailable or non-existent (see Figure 3 for participating states).

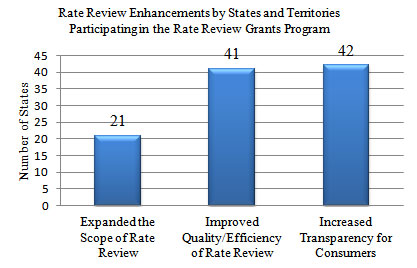

At least 21 states have used grant funds to expand the scope of their rate review programs by reviewing products, business lines, or data that they had not previously reviewed (see Figure 4). For example, Arkansasf Commissioner used his statutory authority to issue a bulletin expanding the Departmentfs authority to include prior approval over rate increases in the small group market, expanded their definition of small group to include small employers up to 50 employees, and permitted the collection and review of insurance company filings serving small employers with 25 to 50 employees. Those employers and employees now receive the protections of rate review. Mississippi has also relied on Rate Review Grant funds to expand consumer protections. On June 29, 2011, Mississippi established prior approval authority in both the small and individual group markets, permitting Mississippi to deny unjustified rate increases starting September 1, 2011. Similarly, South Dakota also enacted a statute that allows the state to deny proposed rate increases.

Moreover, at least forty-one states improved the quality and efficiency of their rate review programs. For example, the Michigan Department of Insurance has improved the depth and rigor of their rate review process. In the past, Michigan only analyzed the methodology used by issuers in developing their premium prices. Now, Michigan is preparing to also directly review rates.

Rate Review Grant funds have provided states with the resources necessary to provide rigorous, data-driven rate review of premium changes and because of these new protections, more people are receiving protection from unjustified rate increases.

Figure 3: Map of Rate Review State Grantees

See a text version of this map.

Figure 4: Rate Review Enhancements by States and Territories Participating in the Rate Review Grants Program

V. The Next Step: Future Enhancements to State Rate Review Programs

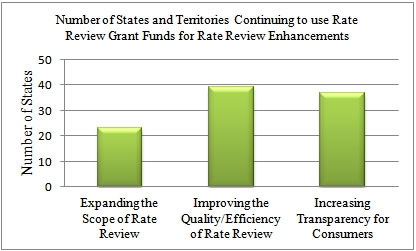

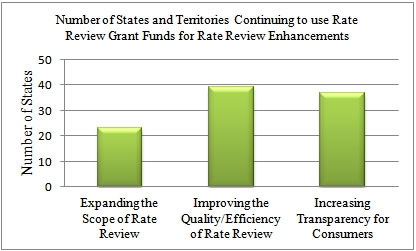

In addition to the already completed rate review enhancements, states continue to use funds to build stronger rate review programs.

Twenty-three states have been working to expand the scope of their rate review authority and thirty-nine states continue to work to improve the quality and efficiency of their rate review programs. In the process of making improvements, states used grant funds to create job positions for actuarial, legal, and consumer support staff (see Figure 5).[8]

Figure 5: Number of States and Territories Continuing to use Rate Review Grant Funds for Rate Review Enhancements

States are also in the process of using grant funds to increase transparency in the future. Examples include:

- Illinois: The Illinois Department of Insurance is developing a web-based gReport Cardh to display premium information on its website for consumers.

- Tennessee: The Tennessee Department of Insurance is collaborating with the University of Tennessee to produce two videos. The first is a 30-second public service announcement about where the public can find information about health insurance rates. It will air in six markets that cover 97 percent of residents in Tennessee. The second is a 90-second video providing details about health insurance rates, the rate review process, and what health insurance plans are available in Tennessee and will be posted on the Departmentfs website.

Ultimately, states and territories participating in the Rate Review Grants Program have developed a range of innovative approaches and solutions to improving rate review that are tailored to each unique local market. As they continue to spend Grants funds, their programs will become more effective at ensuring consumers get the most value for their premium dollar.

Posted on: September 11, 2012

[1] HHS receives rate review data from several sources. The Effective Rate Review Program only captures data on proposed rate increases of 10 percent and over for all states and territories. HHS also receives rate filing information from states participating in the Rate Review Grants Program, which includes data on all rate filings reviewed by these participating states and territories.

[2] Based on HHS determinations of Rate Review Justification data resulting in a lower rate increase, rejected rate, or the requested rate being withdrawn.

[3] The analysis is based on all rate increase requests that have been adjudicated. The rate increase request implemented is equal to the request amount for rates that were implemented without modification, is equal to the modified request for rates that were approved with modification, and is equal to 0% for rates that were rejected. For rates that were withdrawn prior to adjudication and were not resubmitted at greater than 10%, the analysis above assumes that the implemented rate increase is 9.9%. If the analysis instead assumed an implemented rate increase of 0% for withdrawn requests that were not resubmitted, the average reduction would increase to 3.2%. The analysis is weighted by the number of enrollees in each product.

[4] As described in footnote 7, these estimates assume that rate increase requests that were withdrawn before adjudication and were not resubmitted were implemented at 9.9%. If, instead, the analysis assumed that these products did not increase rates at all, the savings to consumers in the individual market would increase to $122 million, and to $53 million in the small group market.

[5] No affected enrollment or estimated savings indicates the state has made no determinations on rate increase requests of 10 percent or more. An asterisk indicates that rate increases implemented are equal to the increases requested. All other numbers indicate approximate savings based on the impact of the modified, rejected or withdrawn rate on the consumers enrolled in the products affected by the rate change request.

[6] This estimate uses information submitted by 41 states through the Rate Review Grants Program and is based on the average difference between rates requested and rates approved. The analysis is not weighted by enrollment, because the enrollment data were not consistently reported. The average difference between requested and approved rates is multiplied by the estimated average premium collected through the Medical Loss Ratio annual reports to determine an approximate premium savings for consumers. This estimate includes data from the reporting states on all rate increases (even those below 10%) in both small group and individual markets and assumes that the difference will be similar in the states that did not report data.

[7] The analysis utilized data collected from 39 states, territories and the District of Columbia that participate in the Rate Review Grant program.

[8] Includes both states and territories.